Step change your net-zero impact

The hardest part of decarbonisation is choosing the right path

Get access to technology with the power to integrate, aggregate and curate diverse data sets, and guide your investment in decarbonisation.

Solutions for organisations and cities

Our deep knowledge in sustainability, emissions reporting and decarbonisation is embedded in our platform, delivering the solutions required for both organisations and cities.

Scope 3 emissions

For every organisation

With increasing scrutiny on scope 3 emissions, we provide you with fit-for-purpose estimations and a mechanism to engage your suppliers and customers to ensure you have better numbers, processed faster.

Financed emissions

For finance and investment

Draw on our library of industry data to quantify the emissions from your investments and understand decarbonisation pathways for those investments and industry sectors.

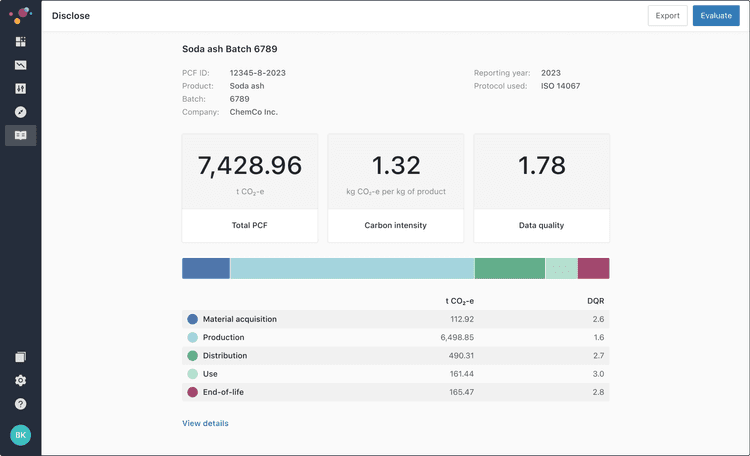

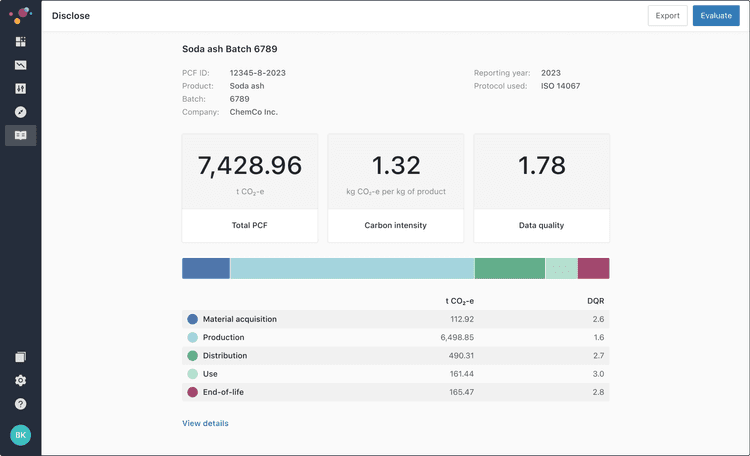

Product disclosure

For manufacturing, agriculture and logistics

Automated carbon footprints calculated for your products, providing clear and transparent reporting to your customers.

Net-zero communities

For cities and government

Develop a pathway to net zero emissions by understanding your baseline emissions and modelling the impact of investments, policies and other interventions

How it works

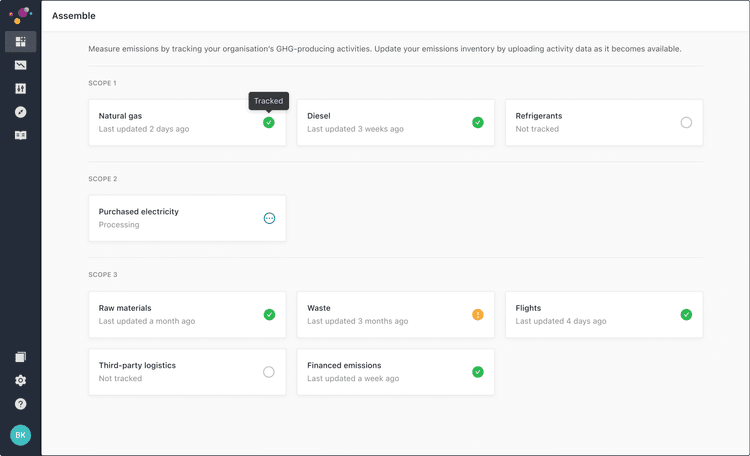

Step 1

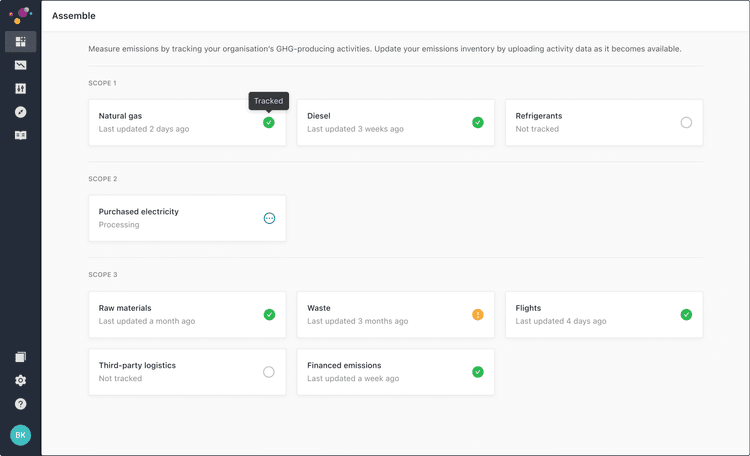

Assemble

Drag and drop files in any format and we’ll do the rest making it easy to capture all scope 1,2 and 3 emissions in one spot without any pre-transformation or templates. Our full service support also means that we can get the data for you.

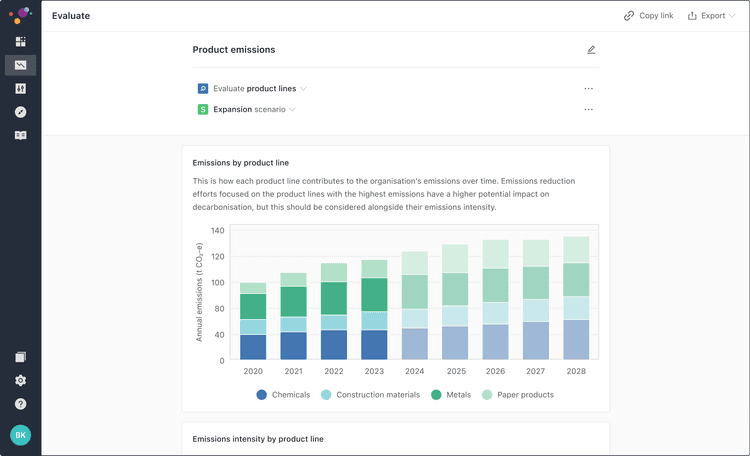

Step 2

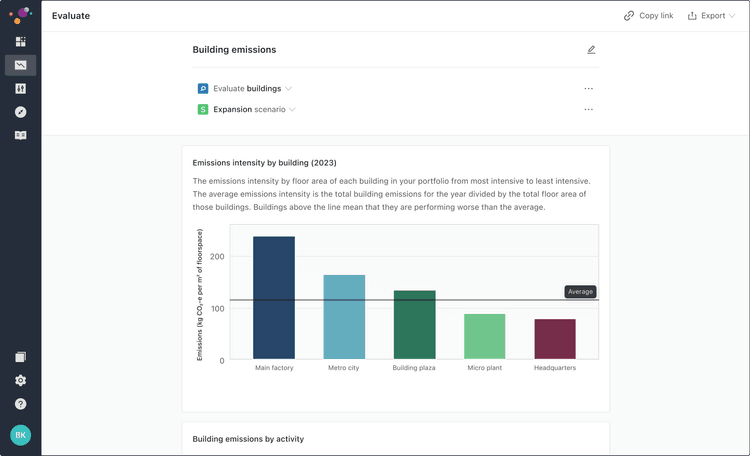

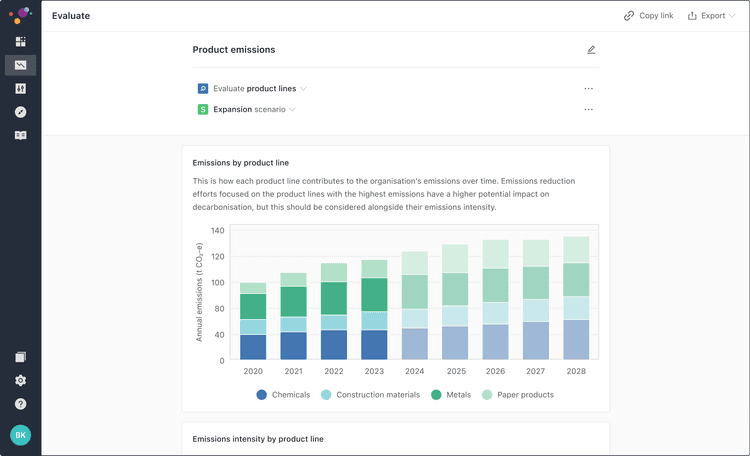

Evaluate

Evaluate business cases in your terms with forward scenario planning and access to our library of industry and sector comparative benchmarking backed by our 15+ years of decarbonisation knowledge.

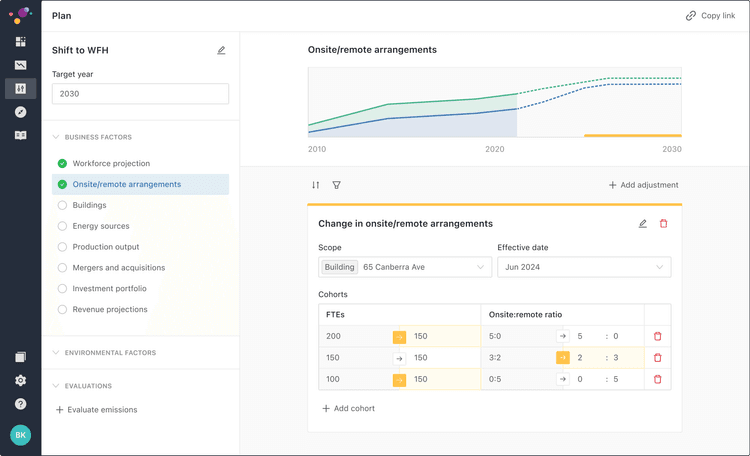

Step 3

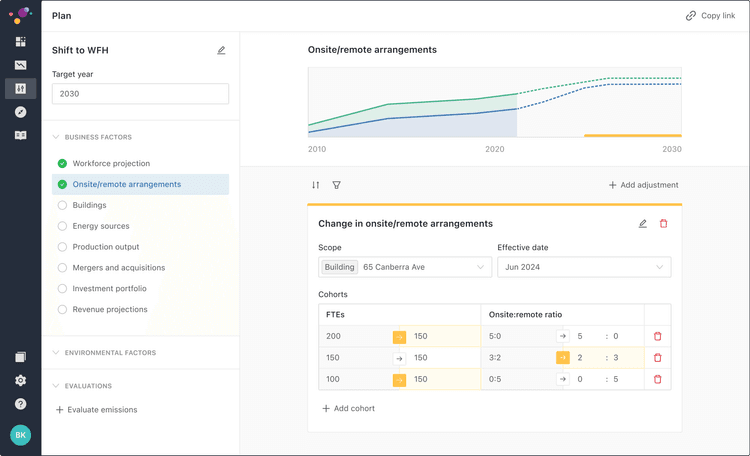

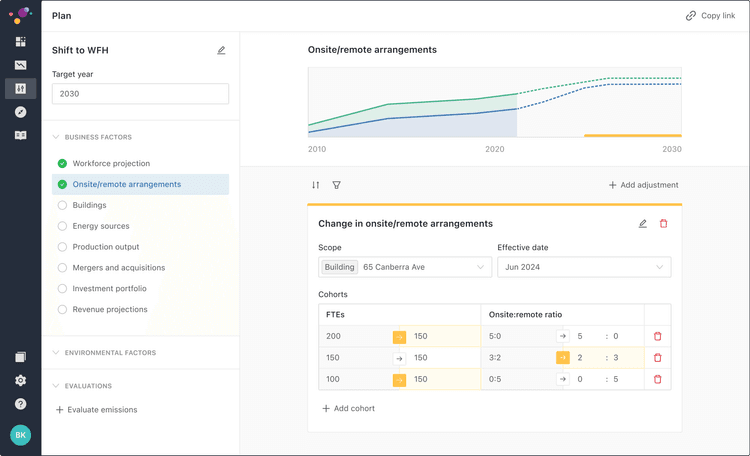

Plan

Plan and set science-based targets against your real business plans, acquisitions and growth. Analyse the impact of opportunities such as work from home, green power, energy efficiency, material substitution and electrification.

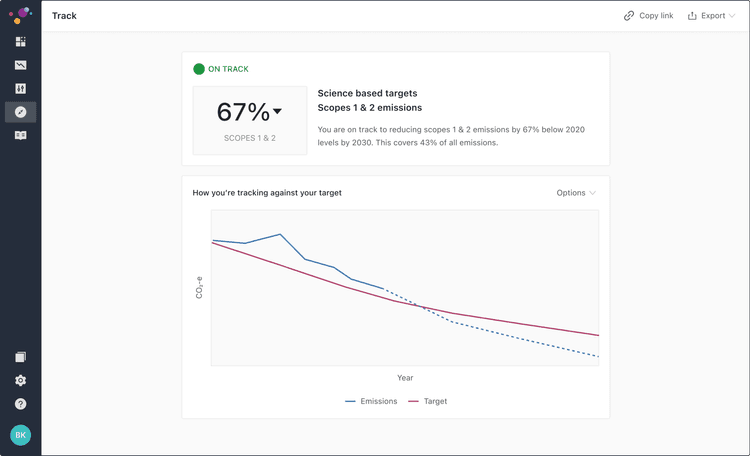

Step 4

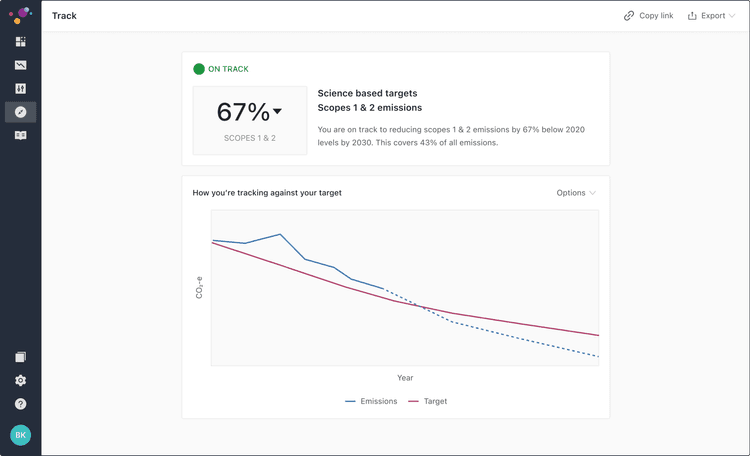

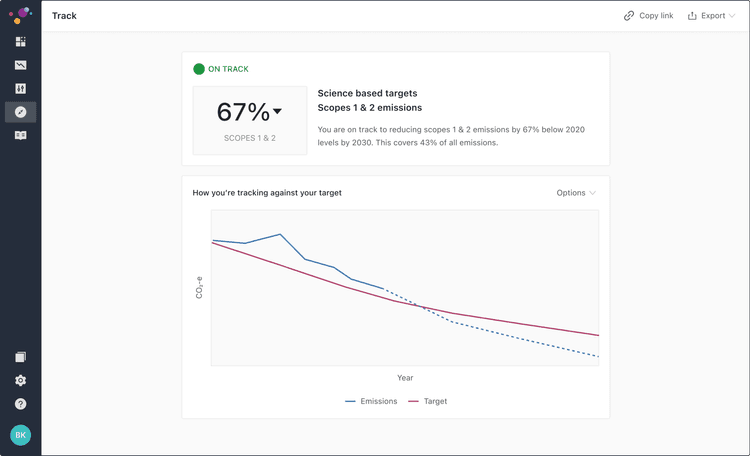

Track

No more surprises with an always up-to-date inventory and accurate projections that account for internal and external changes, such as local grid decarbonisation.

Step 5

Disclose

Provide transparency and clarity on your emissions to customers, shareholders, regulators, and the public. We support frameworks including CDP, TCFD, PACT and SBTi.

Some organisations we’ve worked with

Get in touch

Mailing address

P.O. Box Q164, Queen Victoria Building

Sydney, NSW 1230

Australia

Email and phone

contact@kinesis.org

AU: +61 2 5016 3927

US: (415) 992-9771

Contact us

We’ll get back to you shortly.

We couldn’t send your message. Please check your internet connection and try again.